Health Insurance Tips & Tricks

Guide to Affordable Health Care Insurance Options

RateQuote Direct,

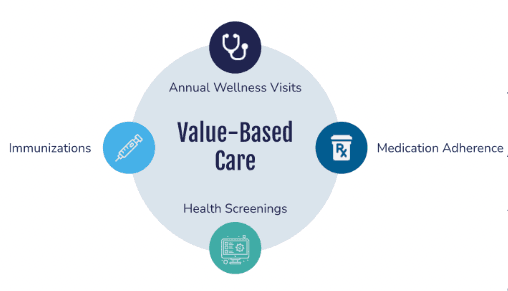

In today's world, having health insurance is essential to ensure that you and your loved ones are covered in case of unexpected medical expenses. However, finding affordable health care insurance can sometimes be challenging. Here is a comprehensive guide to help you navigate the world of affordable health insurance options:

1. Understand Your Needs:

- Assess your healthcare needs, including any pre-existing conditions or regular medications you may require.

- Determine the level of coverage you need based on your family size and health history.

2. Research Different Plans:

- Compare various health insurance plans offered by different providers.

- Look for government-sponsored programs like Medicaid or CHIP if you qualify based on your income level.

3. Consider High Deductible Plans:

- High deductible plans often have lower monthly premiums, making them a more affordable option for healthy individuals.

- However, be prepared to pay a higher out-of-pocket amount before your insurance coverage kicks in.

4. Explore Health Savings Accounts (HSAs):

- HSAs allow you to save pre-tax money for medical expenses if you have a high deductible health plan.

- Contributions to an HSA are tax-deductible and can help you save on healthcare costs in the long run.

5. Check for Subsidies:

- Depending on your income level, you may qualify for subsidies to help lower the cost of your health insurance premiums.

- Explore options on the Health Insurance Marketplace to see if you are eligible for financial assistance.

6. Consider Telemedicine Options:

- Some insurance plans offer telemedicine services that allow you to consult with healthcare providers remotely, saving you time and money.

- Telemedicine can be a cost-effective way to receive medical advice and prescriptions without visiting a doctor in person.

By following these steps and exploring different affordable health care insurance options, you can find a plan that fits your budget and provides the coverage you need. Remember that having health insurance is a vital part of maintaining your well-being and financial security.