Health Insurance Explained

Qualifying Life Events: A Comprehensive Guide

RateQuote Direct,

Qualifying Life Events (QLEs) play a crucial role in allowing individuals to make changes to their health insurance coverage outside the typical Open Enrollment Period. Understanding what constitutes a Qualifying Life Event and how to navigate the Special Enrollment Period (SEP) is essential for maintaining proper health coverage throughout life's transitions. This comprehensive guide aims to clarify the concept of QLEs and provide a roadmap for individuals seeking to make changes to their health insurance due to specific life events.

What are Qualifying Life Events?

Qualifying Life Events are major life changes that allow individuals to enroll in or make changes to their health insurance coverage outside of the annual Open Enrollment Period. These events trigger a Special Enrollment Period during which individuals can adjust their healthcare plans to better suit their current needs. Some common Qualifying Life Events include:

Marriage or divorce

Birth or adoption of a child

Loss of health coverage

Relocation to a new area with different health insurance options

Changes in household size

Becoming a U.S. citizen

How to Qualify for a Special Enrollment Period

Qualifying for a Special Enrollment Period typically involves experiencing a Qualifying Life Event. Here's how you can take advantage of this opportunity:

Report your Qualifying Life Event promptly: Notify your insurance provider about the change within the specified timeline to qualify for the SEP.

Gather necessary documentation: Be prepared to provide documents such as marriage certificates, birth certificates, or proof of loss of coverage to support your eligibility for a SEP.

Review your options: Once your QLE is verified, explore the available health insurance plans and choose one that best fits your new circumstances.

Enroll in a new plan: Complete the enrollment process within the specified timeframe to ensure seamless coverage.

Benefits of Understanding Qualifying Life Events

Having a clear understanding of Qualifying Life Events can offer several advantages:

Ensuring continuous health coverage during significant life changes

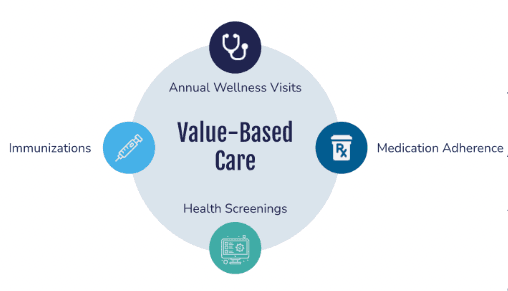

Accessing healthcare options that better fit your current needs

Avoiding penalties for not having health insurance during periods of transition

Securing the right health coverage for you and your family in a timely manner

Conclusion

Qualifying Life Events provide individuals with the opportunity to adjust their health insurance coverage when major life changes occur. By familiarizing yourself with the concept of QLEs and understanding how they trigger Special Enrollment Periods, you can navigate transitions with ease and ensure that you have the appropriate health coverage for each stage of life. Remember to stay informed about the Qualifying Life Events that may apply to you and take timely action to make necessary changes to your health insurance plan.