Health Insurance Explained

The Differences Between COBRA and an ACA Plan Explained

RateQuote Direct,

Choosing the right health insurance plan can be a crucial decision for you and your family's well-being. Two common options for individuals in the United States are COBRA and an ACA plan. Understanding the differences between these two types of health insurance can help you make an informed choice that meets your needs and budget.

COBRA

- Definition: COBRA stands for the Consolidated Omnibus Budget Reconciliation Act, a federal law that allows employees to continue their employer-sponsored health insurance coverage for a limited time after leaving their job.

- Eligibility: COBRA is available to employees who work for companies with 20 or more employees and to their dependents. It is also an option for those who experience a qualifying event, such as job loss or a reduction in work hours.

- Coverage: COBRA offers the same health insurance coverage as the plan provided by the employer. However, the premium may be higher as the employer is no longer contributing to the cost.

- Duration: COBRA coverage typically lasts for up to 18 months, although it can be extended to 36 months in certain circumstances.

- Coverage Continuity: COBRA provides seamless continuity of coverage, ensuring that individuals do not experience a gap in health insurance.

ACA Plan

- Definition: An ACA plan, also known as a health insurance marketplace plan or Obamacare plan, is offered through the Affordable Care Act's federal or state-run health insurance exchanges.

- Eligibility: ACA plans are available to individuals and families who do not have access to employer-sponsored insurance or government programs like Medicaid. Open enrollment periods and special enrollment periods determine when individuals can sign up for ACA plans.

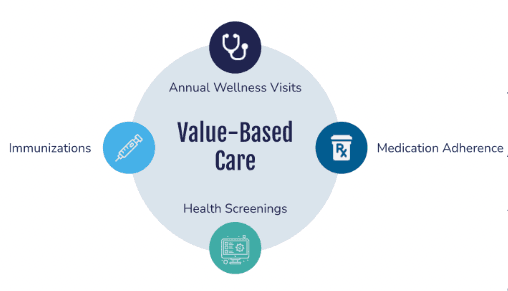

- Coverage: ACA plans provide essential health benefits, including preventive care, emergency services, prescription drugs, and mental health services. Premiums may vary based on income and the level of coverage selected.

- Duration: ACA plans are typically annual contracts, with individuals having the option to renew or change plans during each open enrollment period.

- Coverage Continuity: ACA plans are not tied to employment, offering flexibility for individuals who change jobs or experience other life events.

Key Differences

- Eligibility: COBRA is tied to employment, while ACA plans are available to individuals regardless of their employment status.

- Coverage Options: COBRA provides continuation of existing employer-sponsored coverage, whereas ACA plans offer a range of options with different levels of coverage and costs.

- Cost: COBRA premiums may be higher as the individual is responsible for the full premium, whereas ACA plans may offer subsidies based on income levels.

- Duration: COBRA coverage has a set time limit, while ACA plans are generally annual contracts that can be renewed each year.

- Flexibility: ACA plans provide more flexibility in terms of coverage selection and changes compared to COBRA, which is limited to continuation of the existing plan.

Ultimately, the decision between COBRA and an ACA plan will depend on your specific circumstances, including your employment status, health care needs, and financial situation. It's essential to carefully compare the coverage, costs, and benefits of each option to choose the plan that best fits your requirements.