Health Insurance Explained

Comparing Health Insurance Plans: A Comprehensive Guide

RateQuote Direct,

Choosing the right health insurance plan is a crucial decision that can have a significant impact on your financial well-being and access to healthcare services. With a plethora of options available in the market, comparing health insurance plans can be overwhelming. Here's a step-by-step guide to help you navigate through the process and make an informed decision:

1. Assess Your Needs

- Consider your current health status, medical needs, and budget to determine what coverage options are essential for you.

- Think about factors such as doctor preferences, prescription medications, and anticipated medical procedures.

2. Understand Plan Types

- Familiarize yourself with different types of health insurance plans such as HMOs, PPOs, EPOs, and high-deductible health plans.

- Each plan type has its own network of healthcare providers, coverage rules, and cost-sharing structures.

3. Compare Coverage and Costs

- Review the coverage details including in-network providers, out-of-pocket costs, deductibles, copayments, and coinsurance.

- Consider the monthly premiums, annual deductibles, and maximum out-of-pocket limits of each plan.

4. Check Network Providers

- Ensure that your preferred doctors, specialists, and hospitals are in-network to avoid higher out-of-pocket costs.

- Consider the flexibility of accessing out-of-network providers if needed and the associated costs.

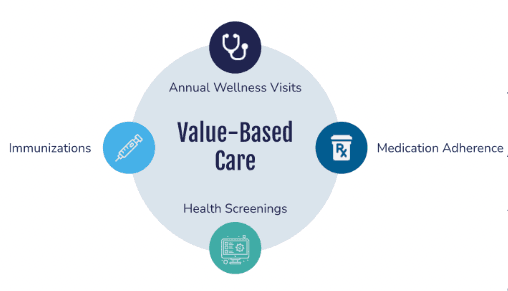

5. Review Additional Benefits

- Look into extra benefits offered by the plans such as coverage for preventive care, mental health services, maternity care, or telemedicine.

- Assess whether features like wellness programs or discounts on gym memberships are important to you.

6. Consider Customer Experience and Ratings

- Research the reputation and customer service ratings of insurance companies to gauge their responsiveness and reliability.

- Read customer reviews and testimonials to understand the overall satisfaction level of members.

By following these steps and carefully comparing different health insurance plans, you can make an educated choice that aligns with your healthcare needs and financial situation. Remember that selecting the right plan not only provides peace of mind but also ensures that you have access to quality healthcare when needed.