Health Insurance Tips & Tricks

Navigating Health Insurance During Economic Changes

RateQuote Direct,

Health insurance is a crucial component of financial planning, providing a safety net for unexpected medical expenses. However, navigating health insurance during economic changes can be challenging. Whether you are experiencing a job loss, a reduction in income, or economic uncertainty, it is essential to understand how to manage your health coverage effectively. Here are some tips to help you navigate health insurance during economic changes:

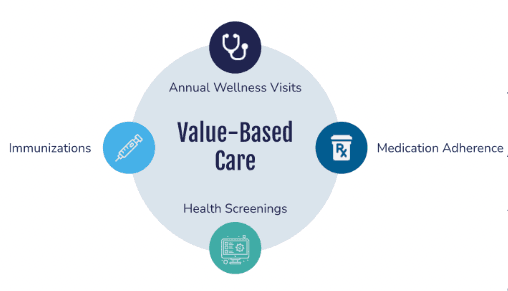

Review your current health insurance policy to understand what is covered and what is not.

Check the network of healthcare providers to ensure you have access to affordable care.

Understand the out-of-pocket costs, including deductibles, copayments, and coinsurance.

Consider enrolling in a spouse or partner's health insurance plan if available.

Research government-sponsored health insurance programs such as Medicaid or the Children's Health Insurance Program (CHIP).

Look into COBRA coverage if you have lost your job but want to maintain your current health insurance for a limited time.

Look for state or federal subsidies to help lower your health insurance costs.

Check with healthcare providers about financial assistance programs or discounts on medical services.

Consider setting up a health savings account (HSA) to save for medical expenses tax-free.

Notify your health insurance provider about any changes in your income or employment status.

Ask about flexible payment options or grace periods if you are struggling to pay your premiums.

Inquire about telemedicine services or lower-cost alternatives for non-urgent medical needs.

Keep up to date with changes in health insurance regulations and policies that may impact your coverage.

Seek advice from a financial advisor or healthcare navigator to help you make informed decisions about your health insurance.

Utilize online resources and tools to compare health insurance plans and find the best coverage for your needs and budget.

During times of economic changes, it is vital to prioritize your health and well-being by ensuring you have adequate health insurance coverage. By being proactive, exploring options, seeking assistance, and staying informed, you can effectively navigate health insurance during financial shifts and protect yourself and your family.