Ai And Health Insurance

The Evolution of Insurance Policies Through Big Data

RateQuote Direct,

Big data has significantly transformed various industries, and the insurance sector is no exception. The utilization of big data in shaping insurance policies has revolutionized the way insurers assess and manage risks, set premiums, and improve overall customer experience. Here's a comprehensive guide on how big data is playing a pivotal role in shaping insurance policies:

Insurers can now analyze vast amounts of data from various sources such as social media, IoT devices, and historical claims to assess risk more accurately.

Big data analytics enable insurers to identify patterns and trends that help in predicting and preventing potential risks.

Big data allows insurers to tailor insurance policies to individual customers based on their unique risk profiles and behaviors.

Insurers can offer personalized premiums and coverage options, enhancing customer satisfaction and loyalty.

By analyzing data in real-time, insurers can detect fraudulent claims and activities more effectively.

Advanced algorithms help in flagging suspicious patterns and anomalies to mitigate fraudulent behavior.

Big data analysis provides valuable insights into customer preferences, behaviors, and needs, allowing insurers to offer more targeted and relevant products and services.

Understanding customer data helps in improving customer engagement and retention.

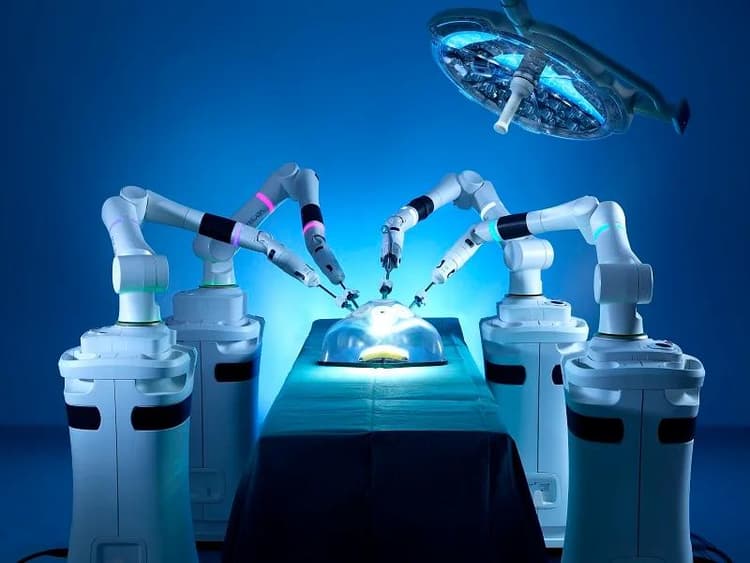

Automation of underwriting processes, claims processing, and customer service through big data analytics streamlines operations and reduces costs for insurers.

Improved efficiency leads to faster response times and better service for policyholders.

With the continuous advancements in big data technologies, insurance companies are increasingly leveraging data-driven insights to make informed decisions, mitigate risks, and enhance customer satisfaction. The integration of big data analytics into insurance policies is reshaping the industry landscape and driving innovation across all segments of the insurance ecosystem.